The Governance Factor©

Measuring Governance

The Governance Factor© combines big data analytics with years of research and experience to provide a simple output that's easy to understand and use. With the number of stock and ESG ratings multiplying it became starkly apparent that few analysts deeply understood or measured governance. The criticality of management teams has long been accepted by fund managers but its quantification has been missing. The Governance Factor© fills this gap.

There are countless hours and years of research, interviews and case studies underpinning its development. It is not the sole purpose of Aspen Pine Capital, but the factor forms a core element of our expertise. At Aspen Pine Capital we extend from governance into the connections of strategy and corporate situation. This focus enables us to provide real and meaningful insights on high value areas.

Functions of the board

A traditional focus on governance explores the functions of the board. It's role as agents of the shareholders and responsibility to reflect their interests when engaging management. In our perspective, the function of the board focuses on three core elements - oversight, strategy and guidance. These elements manage risks, support growth and represent shareholders.

Requirements of directors

Directors must go beyond title and reputation to provide value to a company. They need the time to properly investigate and review matters. Overall, our analysis finds that directors need to have alignment in skills, incentives, and holdings , bandwidth in time and resources, and networks of people and knowledge. Without these requirements the directors won't have the time, resources or alignment to create value.

Objectives of the board

There is more to the boards objectives than providing total shareholder returns. The board must consider how it protects capital as well as grows it. To that end, the objectives of the board revolve around future proofing, risk appetite, culture, returns and the development of intangible assets.

Alignment

Alignment and misalignment are commonly felt in everyday life. It is the same for companies. Misalignment creates awkwardness and problems while alignment ensures smoothness and success. For boards there must be alignment to shareholders, alignment to the company tools and ways of winning and alignment on boardroom behaviour. This is really about enabling discussion and ensuring the skills match the skills and competencies of the organisation.

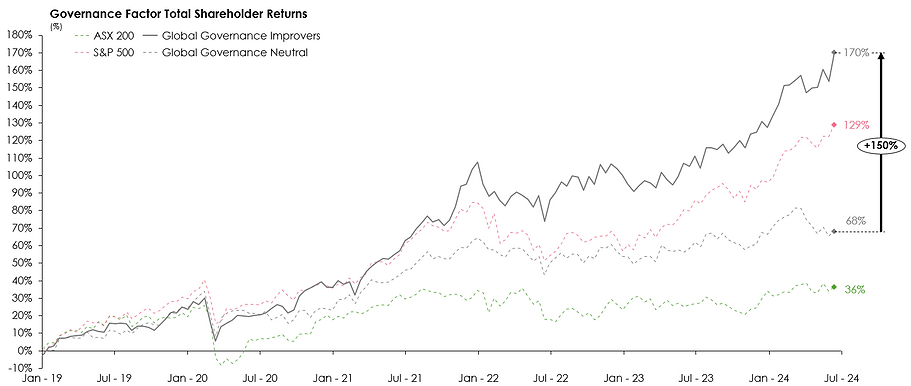

Governance impacts shareholder performance across the globe

When we narrow in on single industries the governance effect persists.

See this mining example.

If you’d like more information about our research and services read our whitepaper and client one pagers